Have you ever had to make an important decision without being sure of the figures you had at hand? Believe me, this is a reality for many companies that still don't take full advantage of the potential of accounting reports.

These documents are essential for any business, whether small, medium or large. They organize all the company's financial information and transform numbers into useful data to understand performance, comply with tax obligations and plot the next steps with confidence.

In this article, we will explore what they are and which 7 accounting reports every company should master. If you want to keep your finances organized and make decisions with more confidence, this content is for you. Let's go?

What are accounting reports?

Accounting reports are documents that record and organize all of a company's financial information. They present, in a clear and structured way, data such as income, expenses, equity, debts and profits.

These records are not only a legal requirement, but also an indispensable tool for financial management. With them, you can see the economic reality of the business and make more confident decisions. In short, accounting reports answer essential questions such as:

- How much is the company gaining or losing?

- What are the main expenses?

- How are the business's assets?

- Are your finances on the right track?

Without these documents, financial management becomes much more difficult, increasing the risk of errors, delays and even losses. They are the basis for understanding the company's financial health and planning for the future with confidence.

Why do accounting reports make such a difference to companies?

Accounting reports come into play when a company needs to manage its figures clearly. They provide a detailed and organized view of the financial situation, helping it to understand the present and plan for the future. But what makes these reports so essential? Here are some reasons why:

- More strategic decisionsWith clear data on income, expenses and profits, it is possible to make informed choices, whether to reduce costs, invest in new opportunities or correct routes;

- Identifying problemsThey help to detect financial bottlenecks, such as excessive expenses or unbalanced cash flows, before they become a bigger problem;

- Compliance with tax obligationsorganized accounting avoids errors and delays in paying taxes, ensuring that the company complies with the law;

- Transparency for investors and partnersWell-structured reports demonstrate trust and professionalism, facilitating fundraising and stakeholder relations;

- Performance monitoringComparing results over time makes it possible to understand the company's growth and measure the effectiveness of the strategies adopted.

In other words, accounting reports bring clarity to a scenario that can often seem confusing and help to turn numbers into real decisions and positive results.

What are the benefits and applications of accounting reports?

As we have seen, accounting reports not only organize finances, but also bring practical advantages to the management and operation of companies. Below you will find table with the main benefits and their everyday applications:

| Benefits | Applications |

|---|---|

| Strategic decision-making | It supports decisions based on real data, such as spending cuts, investments or expansion. |

| Organization and financial control | It makes it easier to keep track of income, expenses, profits and debts. |

| Identifying financial problems | It helps to detect bottlenecks such as overspending or cash flow imbalances. |

| Compliance with tax obligations | It ensures that the company complies with the law and avoids penalties. |

| Transparency for investors | It shows credibility and security for investors, shareholders and partners. |

| Performance evaluation | It allows you to compare results over time and measure business growth. |

| Preparing for audits | Facilitates the presentation of documents and data in external audit processes. |

| Financial planning | It creates a solid basis for future projections and setting financial targets. |

What are the 7 accounting reports you really need to know?

Each of the accounting reports brings an important piece to the financial puzzle: whether it's tracking results, understanding cash flow or ensuring that everything complies with the law. Below, we'll present the 7 main accounting reports that you need to know:

1. Balance sheet

O balance sheet is one of the most important reports, as it reflects the company's financial position over a specific period.

- Key features:

- Divided into Assets (assets and rights), Liabilities (obligations and debts) and Shareholders' equity (the difference between assets and liabilities);

- The structure is based on equity equation: Assets = Liabilities + Equity.

- What does it show? The company's ability to paying off your debtsthe value of its assets and the ratio between equity and third-party capital.

- How to apply it? It helps to analyze the financial strengthIt is also important to check the balance between assets and liabilities and identify whether the business is healthy or in debt.

2. Income Statement (DRE)

The DRE reveals the company's financial performance, calculating the profit or loss for a given period.

- Key features:

- It presents the gross revenue, deductions, production costs or operation, expenses and the net result.

- Organizes data sequentially, from turnover to net profit.

- What does it show?

- How the company is performing financially, highlighting what generates revenue e what consumes resources.

- Evidence profit margin and where there are opportunities for adjustment.

- How to apply it? Essential to understand the operational efficiencyidentify excessive expenses and plan actions to increase profitability.

Watch the video below to find out how to interpret financial statements as a whole effectively!

3. Cash Flow Statement (CFS)

The DFC accompanies all cash inflows and outflows, offering a real view of the financial flow.

- Key features:

- Organized into three categories:

- Operationalday-to-day activities (sales, expenses);

- Investmentsbuying or selling assets;

- Financingraising or paying funds to third parties.

- Organized into three categories:

- What does it show? The liquidity of the business, indicating whether the company can honoring your commitments in the short term.

- How to apply it? Useful for cash flow planningto identify financial imbalances and avoid problems of lack of liquidity.

4. Statement of Added Value (DVA)

The DVA reveals how the company generates wealth and how that wealth is distributed.

- Key features:

- It demonstrates the creation of economic value by the company;

- It shows how wealth is divided between employees, shareholders, the government, financiers and reinvestments.

- What does it show? The company's contribution to the economy and value distribution generated between different stakeholders.

- How to apply it? Important for reports sustainability and for companies committed to teconomic transparency.

5. Daily book

O daily book is a mandatory report that records all financial transactions carried out by the company.

- Key features:

- Organize information in chronological order;

- It includes details such as dates, amounts, accounts involved and descriptions;

- Essential for audits and inspections.

- What does it show? All accounting entries, serving as basis for the other reports.

- How to apply it? Fundamental to ensuring that financial records are organized, detailed and in accordance with the law.

6. Ledger

O ledger details all the movements in each accounting account, complementing the information in the journal.

- Key features:

- It presents the launches in individualized accounts (such as cash, expenses, income);

- It shows the opening balance, movements and closing balance of each account.

- What does it show? The movement of each account over the period, facilitating the detailed analysis finance.

- How to apply it? Used to check errors or inconsistencies in accounting records and facilitate audits.

7. Statement of Retained Earnings (DLPA)

The DLPA shows how the profit or loss is used or distributed over time.

- Key features:

- Details the movement of the company's results (retained earnings, distributed profits or accumulated losses);

- It complements the DRE and balance sheet.

- What does it show? The evolution of the company's net worth, indicating how profits are being reinvested or paid out to shareholders.

- How to apply it? Essential for companies wishing to monitor the distribution of results and strengthen its capital structure.

How to prepare an accounting report?

Drawing up an accounting report may seem like a complex task, but with the right process, everything becomes simpler and more efficient. Here's step by step to create a clear accounting reportaccurate and useful for your company:

Define the purpose of the report

Before you start, ask yourself: what is this report for?

- Is it to monitor financial performance?

- Evaluating cash flow?

- Preparing information for an audit?

Defining the objective helps to choose the type of report and the information it should contain.

Organize financial data

Make sure that all the necessary information is available and organized.

- Gather records of income, expenses, assets, liabilities and equity;

- Use automated accounting systems to avoid errors and inconsistencies.

At this stage, updated data are essential for generating reliable reports.

Keep learning | The complete guide to data quality

Choose the right model

Each accounting report has a specific structure.

- Balance sheetthe company's financial position;

- DRErevenue and expenditure performance;

- DFCcash inflows and outflows.

Define the format according to the objective and follow the accounting standards applicable.

Use automated tools and systems

Accounting automation tools help:

- Reduce the time spent on preparation;

- Ensuring accuracy in calculations and information;

- Facilitate visualization with graphs and tables.

Systems such as ERPs e specialized software are great allies here.

Structure the report clearly

A good accounting report should be:

- Objective and organized: highlight essential information;

- Visually accessibleuse tables, graphs and summaries to make reading easier;

- Easy to interpretavoid complex technical terms without explanation.

Review the information

Before finalizing, proofread everything carefully:

- Check that the calculations are correct;

- Make sure the data is complete and up-to-date;

- Confirm that the information is consistent with the purpose of the report.

Present and share with stakeholders

Once the report is finished, present the results clearly:

- To managers and leaders, highlight critical points and important insights;

- To investors or auditorsensure transparency and accuracy of information.

Tip: adapt the language and format according to the target audience.

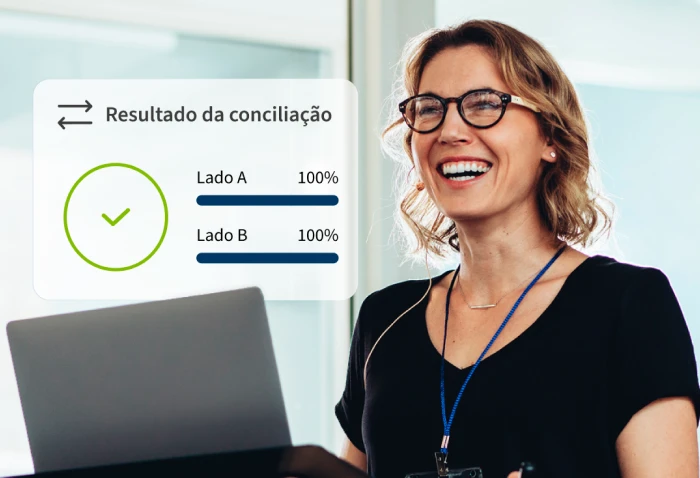

How can automation make it easier to manage your accounting reports?

If you've ever wasted time organizing spreadsheets, correcting errors or trying to deal with manual processes that never seem to end, know that the automation can transform your routine.

With intelligent tools, it's possible to generate accounting reports in a simple way. fast, precise and uncomplicated. Automation makes it possible:

- Reducing human error by integrating data directly from financial systems;

- Saving time with automated processes that eliminate manual steps;

- Increasing precision information, guaranteeing reliable reports for strategic decisions;

- Simplifying everyday life the accounting team, which can focus on analysis rather than repetitive tasks.

Want to find out how automation can optimize your company's accounting reports? Fill in the form below, discuss your processes with one of our experts and see in practice how to simplify your financial management!