How to calculate ICMS-ST?

Calculating ICMS-ST: in this article, you'll learn how to do it effectively, what the tax incentives are in each state and how automation can help.

Tax incentives: why are they crucial for the economy?

Tax incentives: a driving force in the economy. Find out about the main ones and their importance for social and economic development.

Tax obligations: what are the main ones for large companies?

Tax obligations refer to the legal duties imposed on taxpayers by a tax authority. Read the article and find out more!

Tax complexity: simplify with automation

Tax complexity: explore how automation can be the key to overcoming tax challenges and boosting your company's growth.

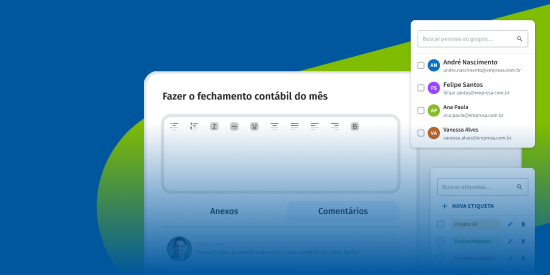

Tax closing: 5 steps to successful completion

Tax closing: learn the 5 essential steps to simplify the process and avoid errors, improving your company's efficiency.

Tax compliance: the practical guide!

Tax compliance needs a series of good practices to be structured assertively in your company's policy. Check out this complete guide!

Accessory obligations: what are the main ones for large companies?

Accessory obligations are declarations of data relating to the company's operations that are submitted to the government on a regular basis. Find out more!

Tax reconciliation: the definitive guide on how to do it

Tax reconciliation: learn how to do it efficiently in this complete guide and save time and resources!

Tax reconciliation: step by step to do it efficiently

Tax reconciliation is the path to efficient tax management. Follow our step-by-step guide and optimize your processes now!

Tax management: what is it and what are the best business practices?

Fiscal management: take a look at good practices to ensure that it is efficient and transparent, reducing costs and fulfilling your legal obligations.